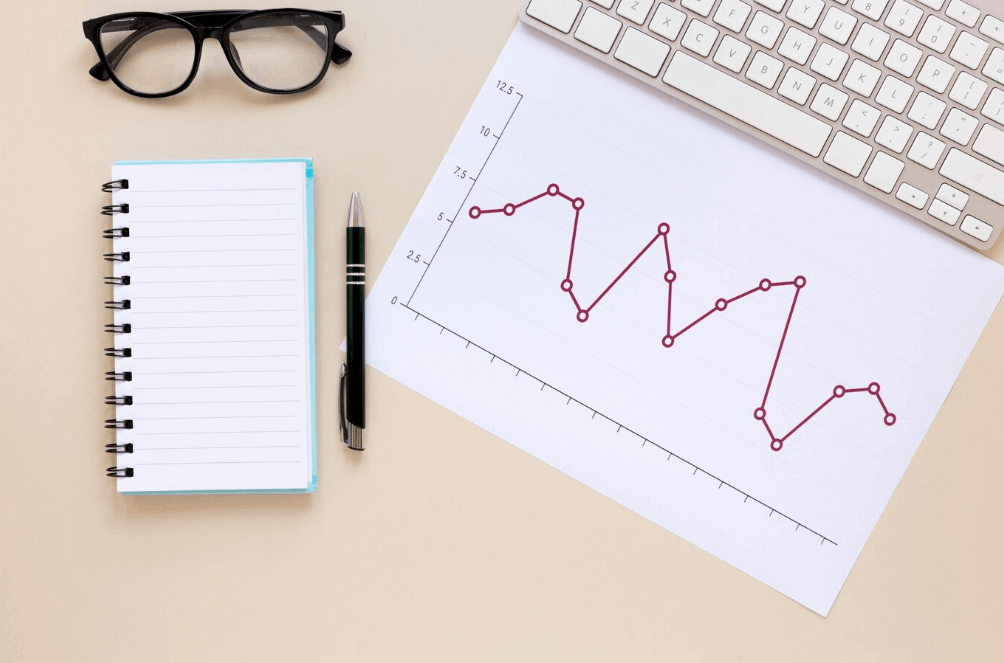

Understanding Credit Score Ranges: What They Actually Mean

Navigating the world of credit score ranges can feel overwhelming, but knowing where you stand is the first step to taking control of your financial life. In this article, we explain what each range—from poor to excellent—really means for your loans, cards, and approvals. We also break down how lenders interpret your credit score, and why staying in the "good" or "very good" range matters more than aiming for perfect. Plus, we share tips for moving up the ladder with confidence and clarity.

How to Use Experian to Track and Improve Your Score

If you’ve ever asked “What is experian?” or wondered how to log in, you’re not alone. This article walks readers through the experian login process, what information they’ll find on their dashboard, and how to read it. We explain the tools available on the platform—like free reports, risk indicators, and alerts—and how to leverage them to maintain or boost your credit score. We also include the official experian phone number for customer support, just in case something goes wrong or you need to speak to a representative.

Should You Request an Experian Credit Freeze?

A credit freeze with experian can be a powerful tool for preventing fraud or identity theft. But is it the right move for you? This article breaks down the pros and cons of placing a experian credit freeze on your report. We explain how it affects your access to credit, how to request one, and how to temporarily lift it if needed. We also guide readers through the experian login steps to manage the freeze settings and share the official experian phone number in case additional assistance is required.